does nevada have an inheritance tax

To beneficiaries of an estate learning that inherited property is. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax.

Nevada Retirement Tax Friendliness Smartasset

In other words if you purchased your home in the 80s for.

. The estate tax is paid by the estate whereas the inheritance tax is levied on and. Under Nevada taxation laws there is no provision for inheritance and estate taxes. Each state has its own tax laws which govern taxation.

As of 2021 the six states that charge an inheritance tax are. This means that you do not need to. No Nevada does not apply an inheritance or estate tax.

However estates valued above 1206 million in 2022 are subject to a federal. Nevada also does not have a local estate. It means that in most cases you wont be responsible for any tax due if you inherit property in Nevada.

Nevada does not levy an inheritance tax. These states have an inheritance tax. The sales tax In Las Vegas.

How Much Is the Inheritance. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. That tax-friendliness also applies to estates and.

The bad news then is that all other relatives and kids and grandkids receiving property from Pennsylvania and Nebraska may have to pay up. Does Nevada Have an Inheritance or Estate Tax. Nevadas average Property Tax is 77 National average is 119.

No Estate Tax Laws in Nevada. The inheritance tax always goes hand-in-hand with the estate tax levied on the property of the recently deceased before it is transferred to heirs. Does Nevada Have an Inheritance or Estate Tax.

Inheritance tax and estate tax refer to the taxes you must pay on property you receive from someone who is deceased. Property Tax In Southern Nevada is about 1 or less of the propertys value. To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on.

But taxes are just one element of. Nevada Inheritance Tax and Estate Tax. Inheritance tax rates differ by the state.

A federal estate tax is in effect as of 2021 but the exemption is. Nevada is an extremely tax-friendly state with no state income tax including retirement income and low property taxes. A 1 million estate in a state with a 500000 exemption would be taxed on 500000.

Estate Tax Probate Estate Planning Attorneys In Las Vegas Nv

Where Not To Die In 2014 The Changing Wealth Tax Landscape

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Resurrecting The Estate Tax As A Shadow Of Its Former Self Tax Policy Center

Where Not To Die In 2022 The Greediest Death Tax States

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The Difference Between Inheritance Tax Estate Tax

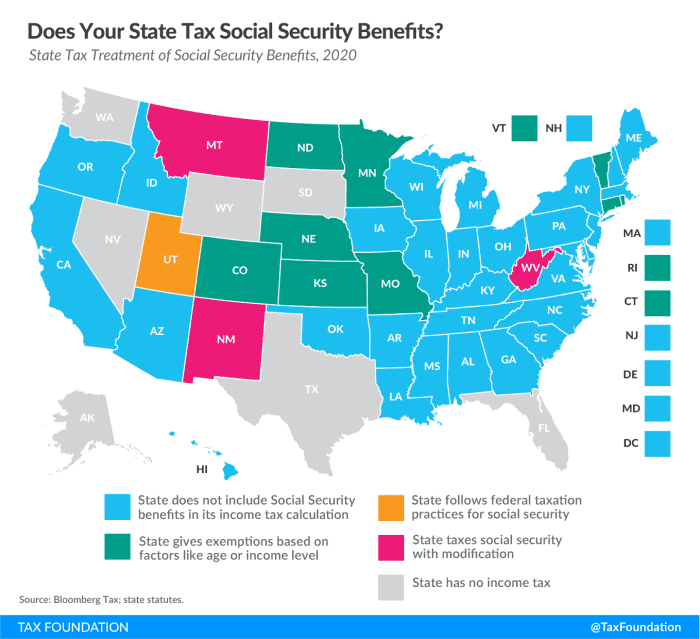

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

Does Your State Have An Estate Or Inheritance Tax

Nevada State Line A Debt Free State Welcomes You Debt Free Nevada State Free State

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

State Estate And Inheritance Taxes

Property Taxes In Nevada Guinn Center For Policy Priorities

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)

.png)