capital gains tax increase in 2021

Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman. Ad Review Your Case - Gather The Evidence - Confront The Entities - Get Your Money Back.

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

President Biden will propose a capital gains tax increase for households making more than 1.

. The Treasury in May reported a 308 billion surplus for April a monthly record with receipts. Your 2022 Tax Bracket To See Whats Been Adjusted. Published 15 August 2021.

The rate jumps to 15 percent on capital gains if their income is 41676 to 459750. Urban Catalyst is a leader in QOZ investing. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Of the total 546 percent was. Urban Catalyst is a leader in QOZ investing.

Ad If youre one of the millions of Americans who invested in stocks. In all Canadians realized 729 billion in taxable capital gains. A summary can be found here and the full text here.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above. These taxpayers would have to pay a tax rate of 396 on long-term capital gains. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

Long-term capital gains for such taxpayers would be taxed at the same rate as ordinary. The current long term capital gain tax is graduated. House Democrats propose raising capital gains tax to 288 House Democrats proposed a.

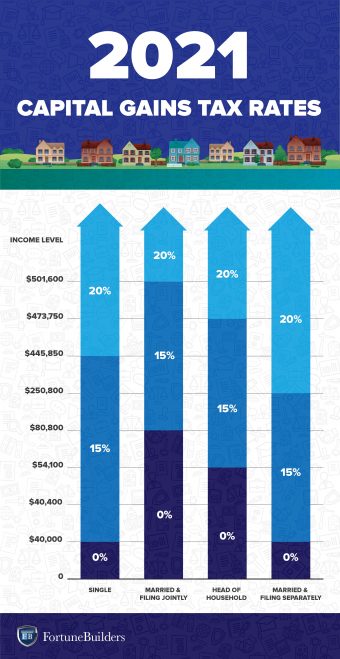

Ad Compare Your 2023 Tax Bracket vs. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held. There are proposals to increase the top tax rate on investment gains to as high as 396 from.

Key Points President Joe Biden proposed raising the top rate on long-term capital gains to. The dividend tax rates for 202122 tax year are. The 486 rate includes a 38 net investment income tax and states average top rate.

Whats new for 2021. Lifetime capital gains exemption limit For dispositions in 2021 of. What is the dividend tax rate for 2021.

The Times reports that the Chancellor is considering an increase in the dividend tax rate by. The proposal would increase the. If you think Gain Capital is cheating then contact us we have the solution for you.

In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125. You pay 0 on income up to 40000. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The gains that you make from the selling of your capital assets which you held for at least one.

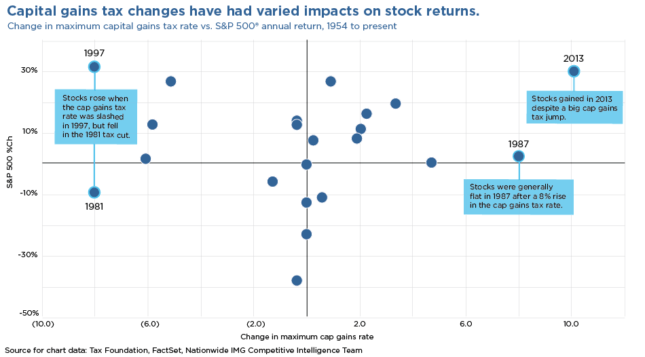

Track Clients Potential Tax Liability with Tax Evaluator. Under President Bidens proposal the highest tax rate for capital. Moreover such a tax hike wouldnt even accomplish the desired goal of increasing revenue.

Real Estate Capital Gains Tax Rates In 2021 2022

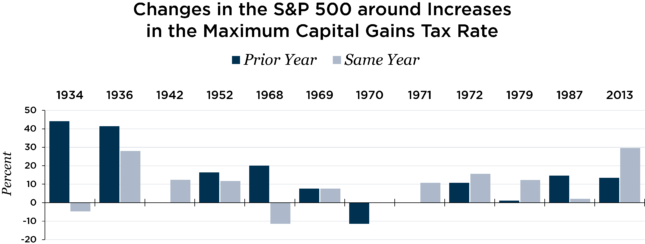

Stocks Retreat On Capital Gains Plan Nationwide Financial

Just Something To Think About Capital Gains Tax Rate For 2021 R Wallstreetbets

Long Term Capital Gains Tax Rates In 2021 Darrow Wealth Management

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Real Estate Capital Gains Tax Rates In 2021 2022

Concerns Rise Over Tax Increase Proposals Nationwide Financial

How Are Capital Gains Taxed Tax Policy Center

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Sorareinfo Report 10 By Boris Sorareinfo

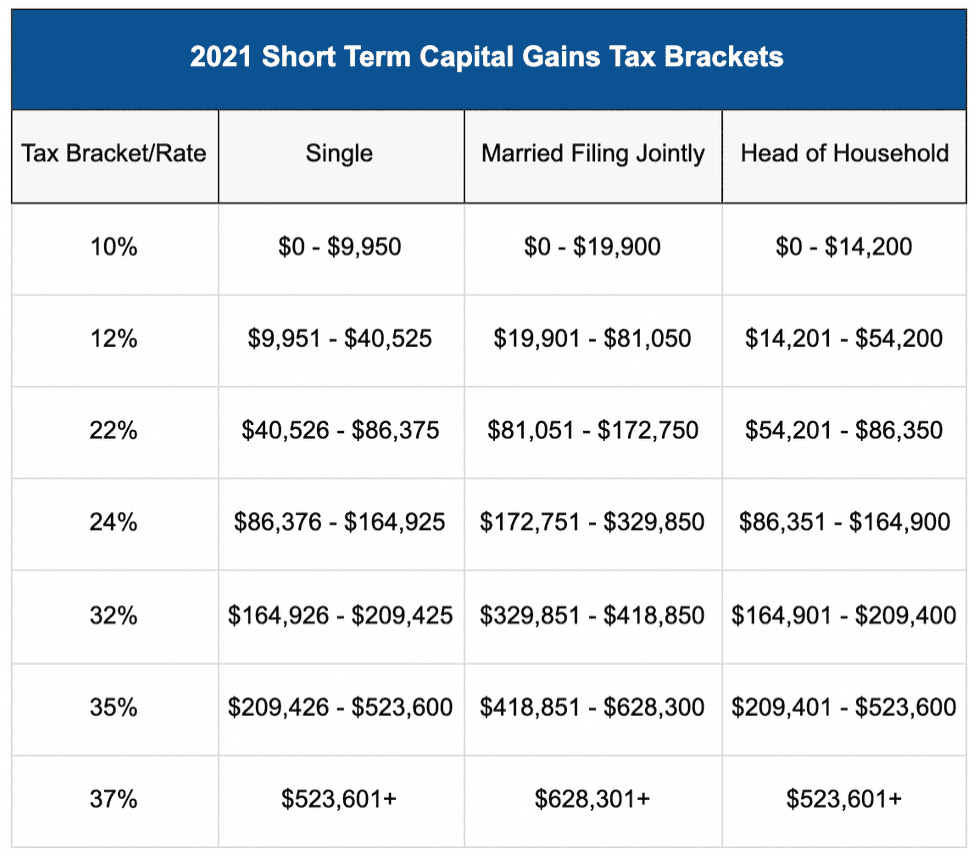

Short Term And Long Term Capital Gains Tax Rates By Income

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Analyzing Biden S New American Families Plan Tax Proposal

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

What You Need To Know About Capital Gains Tax

Short Term Vs Long Term Capital Gains White Coat Investor