will salt get repealed

Its repeal was also included in House Democrats COVID. House Democrats are considering a two-year repeal as one of their potential paths to undoing the 10000 cap on the federal deduction for state and local taxes.

Letter Argument Against Salt Tax Repeal Misleading

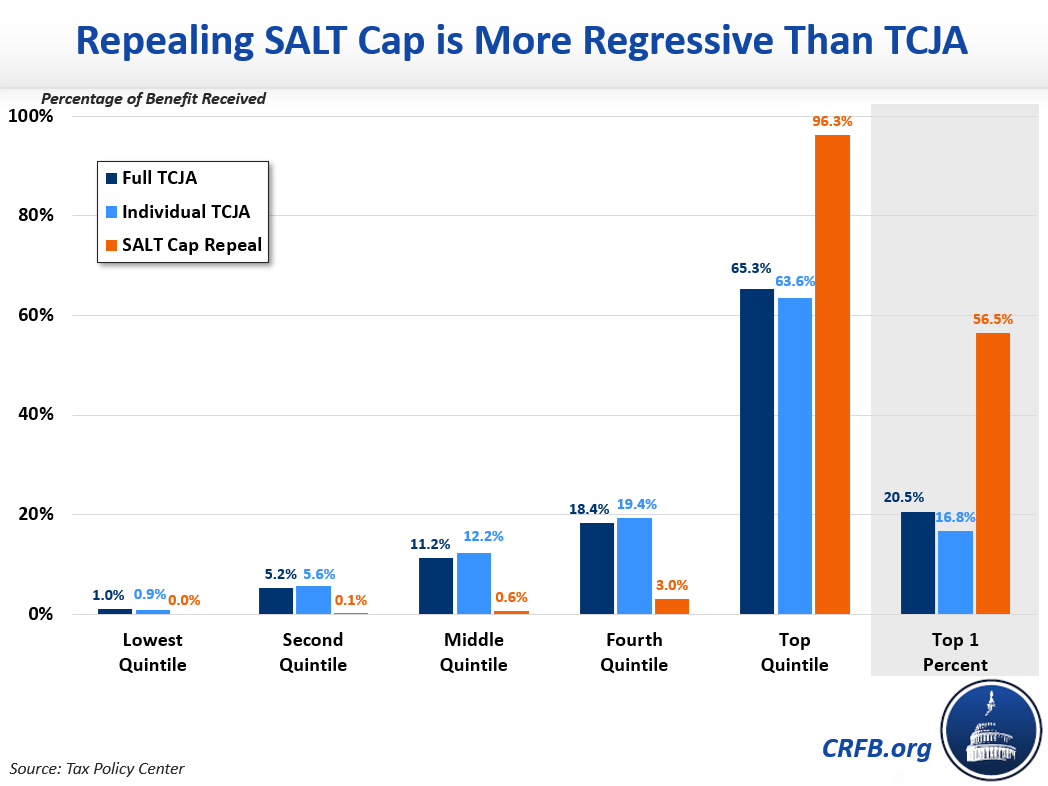

The Tax Policy Center found that only 3 of middle-income households would pay less in taxes.

. Tom Suozzi writes For 100 years. Among itemizers those in low tax brackets. SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of high-tax states like New York and New Jersey.

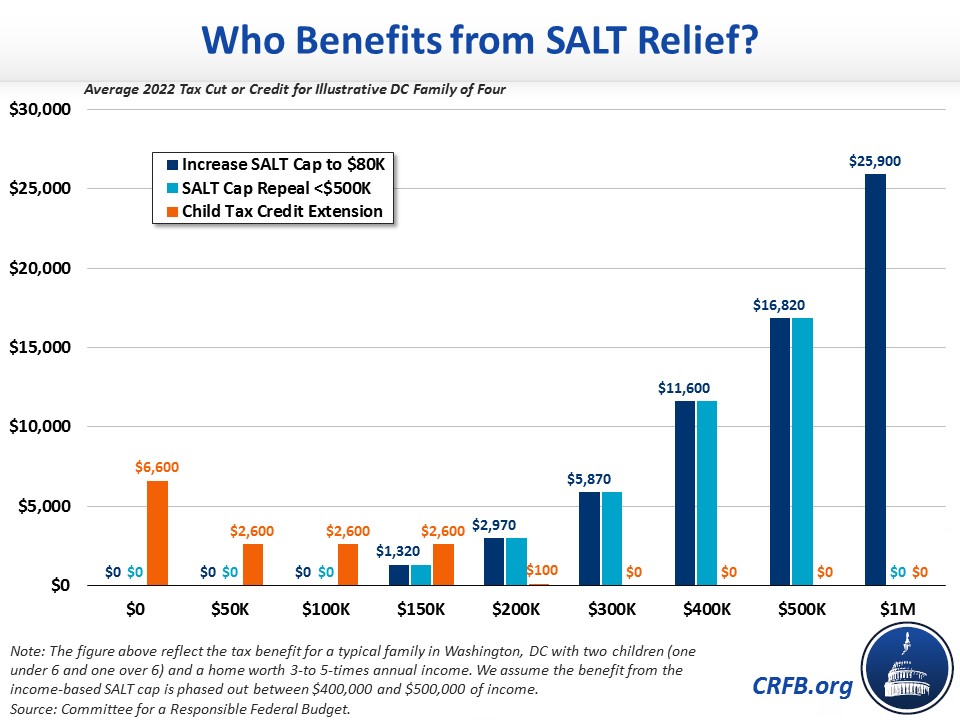

House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the. No SALT no deal they said. The SALT deduction benefits only a shrinking minority of taxpayers.

Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. The SALT cap repeal would influence taxpayers differently based on itemization status tax bracket and state and local taxes paid. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the state and local tax salt deduction cap for.

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. Analyses found that repealing the cap would disproportionately benefit the wealthy. Bernie Sanders I-Vt blasted reports that a SALT repeal may be included in the family and climate spending plan calling it unacceptable At a time of massive income and wealth.

Will Salt Get Repealed. Published Fri Jun 3 2022 156 PM EDT Updated Fri Jun 3 2022 207 PM EDT. In late 2019 House Democrats joined by five Republicans passed a bill to temporarily get rid of the SALT cap.

The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats. Middle-income households would get an average tax cut of about 20 in 2021 from either proposal largely because only about 10 of taxpayers actually itemize their deductions. House Democrats push Treasury IRS for repeal of rule blocking state and local taxes cap workaround.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Democrat Floats Paying For Salt Cap Repeal With More Tax Audits Bloomberg

Lawmakers Offer Bill To Repeal Cap On Salt Deduction The Hill

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Opponents Pull In Union Support To Promote Repeal Bloomberg

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Lawmakers Who Ran On Salt Relief Prepare To Face Voters Roll Call

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Democrats Search For Sweet Spot On Salt Deduction Roll Call

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

Repealing The Salt Cap Would Be More Regressive Than The Tcja Committee For A Responsible Federal Budget

Are Democrats Worth Their Salt Wsj

State And Local Tax Deduction Cap Repeal Does Not Belong In Reconciliation Package Crfb Director Youtube

Blue State Lawmakers Launch Effort To Repeal Salt Cap Politico

What Salt Tax Cap Repeal Could Mean For Florida S Migration Momentum Tampa Bay Business Journal

The Push To Repeal The Salt Cap The Long Island Advance

White House Threatens To Veto Bill To Temporarily Repeal Salt Deduction Cap The Hill